Introduction: preparing the pre-bull market

The 4 things to take care to make your business or a bank blockchain ready

The concept of Interoperability

How Much is Chain Interoperability Worth?

What is inside DCRM

How does Fusion’s DCRM works?

Comparison Table

Advantages of DCRM

Conclusion

Intro: Are you surprised by the recent increase in Bitcoin price, I am not!

An increasing number of wealth managers are looking to diversify their portfolios with digital assets such as cryptocurrencies, security and utility tokens and tokenized investment vehicles. However, security and convenience are still major barriers for sophisticated and traditional investors. Is the ecosystem ready for banks and portfolio managers to offer crypto assets to their clients? What are the challenges of integrating this new asset class within the traditional wealth management portfolio? How can we overcome these challenges?

Hello everyone, my name is Karim Chaϊb technology leader, XDLT founder and Fusion Chief Crypto Officer and I like to get things done! In 2017 I decided to push a world leading banking software provider with 4 Trillions Assets Under Management located in Switzerland to the journey of supporting digital assets. My core motivation was the simple idea that for crypto mass adoption, people needed to have an easy access to cryptocurrencies and digital assets. Bank clients should not have to withdraw their money to buy and store tokens in some risky foreign crypto-exchanges. The solution we built enables clients to simply use their own e-banking or call their wealth manager to buy and sell cryptocurrencies.

In this article, we explore the latest developments in the crypto assets space and the technological advancements that enable institutional and sophisticated investors and even your own business to participate in the new opportunities presented by the tokenized economy.

The 4 requirements to make your business blockchain ready :

1. Custody solution (where and how to store your crypto assets): Perhaps the most important component of holding digital assets is determining how to store and protect your private keys. Ask yourself where you would store your private keys or the private keys that belong to your customers? Who has access this storage facility? tackle this point first and review the various crypto HSM provider offering carefully.

2. Legal framework and architecture: During my time working with many crypto projects, I have engaged numerous lawyers specialized in the digital asset law and found out the following:

A. Keep the private key of your clients segregated (no omnibus account) to increase security and minimize the responsibility of the bank. Moreover in this way, those assets would not appear in the Bank balance sheet.

B. Custody provider must support all and any forks as this represents value to the client.

C. Regulators force Anti-Money-Laundering (AML) on crypto wallet to be performed on each transactions.

3. Market Validation:

In June 2018 I did the first prototype and prepared a demo at our yearly conference, when our clients noticed that they could also support crypto currencies natively. In 1 week several big banks were lined up and ready to start a pilot, in fact digital asset is the way for banks to distinguish their all identical services and attract new generation of clients (generation X, Y, Z). Furthermore studies showed that younger generation are more inclined to purchase cryptocurrency than invest in traditional shares.

So if you ask me if I’m personally bullish on the price of crypto. 2018 and 2019 were bearish years for most people, nevertheless what few people know, is it has been the years where the smart money was invested by banks to build the technical system to support cryptocurrencies, and more broadly digital assets. The products soon to hit the market will be sponsored by the banks directly, including bank backed cryptocurrency debit cards, STOs and even ICOs. This provides clients with a more formal way of entering the cryptocurrency market as opposed to dealing with the oftentimes shady ICO environment of 2017/2018. This also provides local corporate customers with another avenue to raise money and ultimately increase their Assets Under Management (AUM). The race between banks is on how much crypto assets they are able to support so they can provide their clients the greatest amount of choice.

4. Implementation: During the architectural phase we found out 2 big challenges:

- Where to get crypto AML, settlement information, and access all transactions from any blockchains simply with SQL or API calls?

(short answer I founded XDLT) - How to integrate all this different blockchains and cryptocurrencies (more than 2000) efficiently? (short answer I joined the Fusion Foundation)

Indeed I was looking to identify in the market an easy solution allows us to integrate all this distributed ledgers technologies within just one blockchain. The inability for isolated blockchains to communicate with one another is a recurring problem in the decentralized landscape. Isolated inter-blockchain communication can put a strain to blockchain’s scalability and mainstream adoption.

The concept of Interoperability — Compatibility VS Interoperability.

Interoperability is the concept of connecting otherwise siloed blockchains to enable seamless interaction across different systems. This facilitates the development of decentralized applications that can interoperate with more cross-chain and enable the unrestricted transfer of value and Logic in a decentralized and trustless way.

In the blockchain landscape there are 2 concepts that are mistakenly associated Compatibility VS Interoperability. Compatibility implies setting a standard and forcing industry participants to adopt that standard, reducing flexibility and requiring a rigid model for every solution. I was searching for something better, it was obvious to me that I wanted a cryptographic interoperability solution that didn’t force conformity.

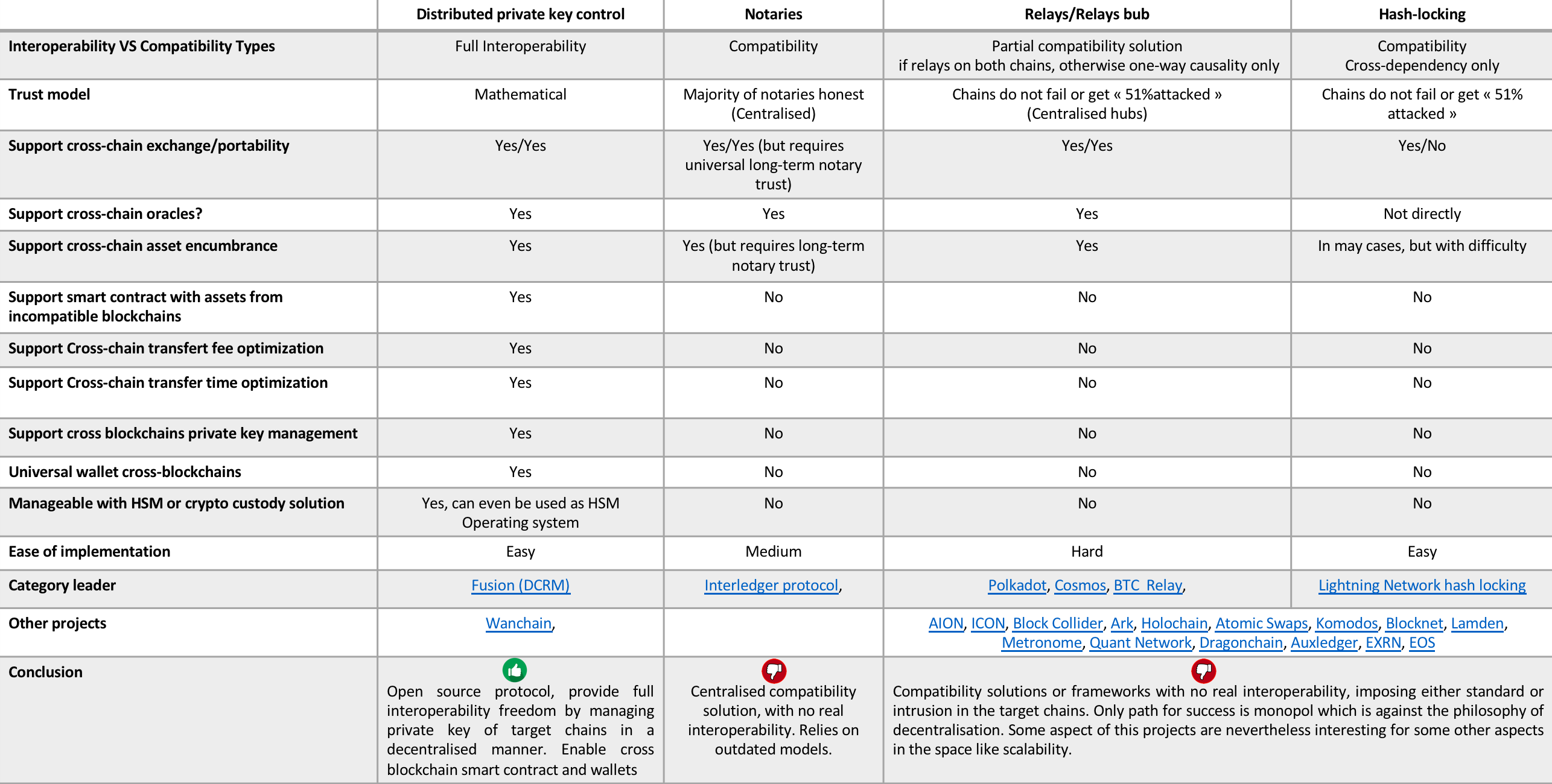

Compatibility: Notary schemes, Relays (Sidechains/relays) and Hash-locking.

- Notary schemes: In this system, a trusted entity or group is used in order to claim that a given event on a sub-chain has taken place or that some claim is true. These may be actively listening and automatically acting based on events on a given chain or passively issuing signed messages only when prompted.

- Relays: This requires independently verifying the block header that contains the transactions important to it’s use. This needs verifying all branches of the Merkle tree within that block, the time between transactions is directly dependent on the block time associated with each chain with the “worst possible” scenario time-to-verify for the cross-chain transaction.

- Hashlocking: Relatively simple and limited in their capability, this is one method for achieving atomic swaps. It does this by having both users locking their funds in a smart contract that only releases after the first user provides the key which unlocks both.

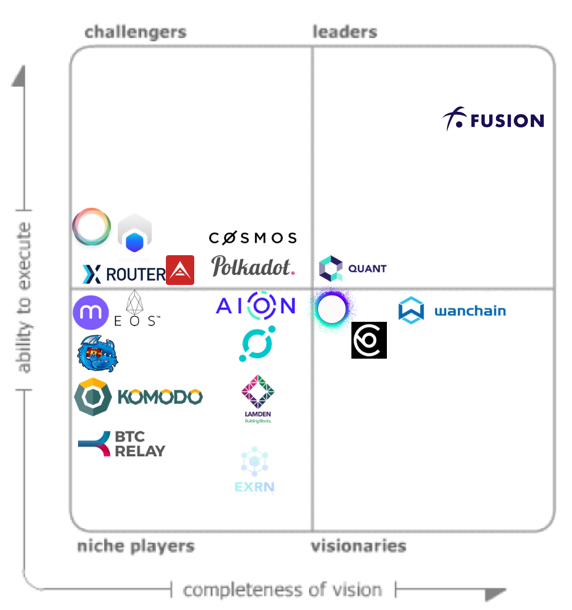

Projects in the compatibility category: Polkadot, Cosmos, Interledger protocol, BTC Relay, Lightning Network HTLC hash locking technology, AION, ICON, Block Collider, Ark, Holochain, Atomic Swaps, Komodos, Blocknet, Lamden, Metronome, Quant Network, Dragonchain, Auxledger, EXRN, EOS

Projects in the cryptographic interoperability (true interoperability) Fusion with distributed private key control (DCRM), and Wanchain,

I was searching for a solution that is able to manage any kind of blockchain without having to impose a strict standard to any of the underlying ledgers or to have to trust some third part provider. In February 2018 only 2 projects were moving in this direction, Fusion and Wanchain, using different models of distributed private key sharding to achieve blockchain interconnectivity.

Within the past 6 months, the Fusion project has distinguished itself by advancing their cryptographic research and validating their highly innovative interoperability solution known as DCRM. The strength of their core technical team and their ability to gather the best cryptographers in the world (Paillier, Gennaro, Goldfeder, Goubin) to work on DCRM is a major credit. Fusion are in the final stages of validating a truly new and unique way to manage private keys without compromising decentralization.

How Much is Chain Interoperability Worth?

I have little doubt at this point that crypto is eventually going to capture trillions of USD worth in capitalization. I thought If someone can get the interoperability of distributed ledgers right, the demand for this solution will be huge. If that interoperability solution is linked to a utility token, then demand, of course, will drive up the price. I followed up with the Fusion team and tested the Fusion DCRM code, reviewed the math and was blown away. I decided to join Fusion and was granted the opportunity to onboard the best cryptographs in the world to verify that the security was verified.

Fusion is a non-profit organization that offers their DCRM code as open source to help:

- Banks, exchanges, wealth managers, banking software providers that that require a ready to use interoperable blockchain will collaborate with Fusion to utilize their technology suite:

-Military grade security for private key custody.

-Universal digital asset portfolio that contain any crypto currencies or digital assets.

-Tools for decentralized exchange

-Features that easily express financial instruments

-Fast and cheap transactions

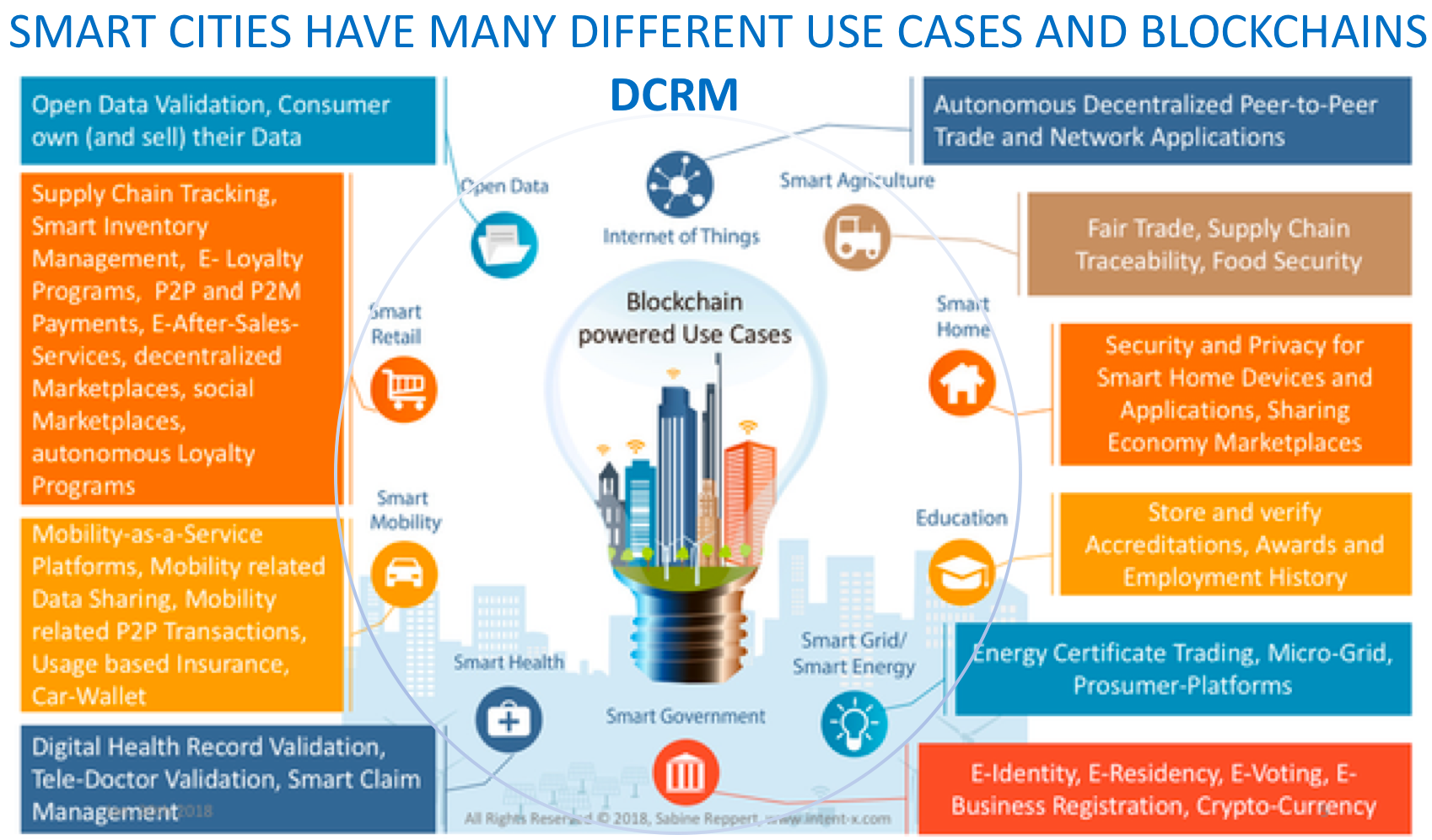

- To support interconnected smart cities and industries that require many participants to work together and to interoperate across different systems.

- DCRM can create cross blockchain, cross process interactions that can support countries like UAE, i.e Dubai where by 2020 many of the cities processes will be built on blockchains.

- Any blockchain project (in particular the one mentioned in this study) who wants to benefits from this true cryptographic interoperability breakthrough and wants to bring the all ecosystem forward.

- Any custody provider or hardware security module provider can benefit from Fusion’s DCRM, to increase security, by removing any single point of failure. DCRM is deployable as an OS in the HSM box and can scale indefinitely or it can be set in the cloud. You can even think of a network of various HSM providers who collaboratively create a distributed custody service that also applies DCRM to their hardware interoperability. This initiative could be lead by several banks together, willing to share hardware cost and increase speed and maximize security.

Is this all? surely not!

It is still difficult to quantify how the combination of distributed ledger technology with complete blockchain interoperability can revolutionize industries, for example even Mark Zuckerberg is researching blockchain with his team at Facebook, exploring authentication was “a use of blockchain that I’m potentially interested in,” although “I haven’t found a way for this to work.”

“We believe that DCRM protocol is as important for decentralized (blockchains, DLT) and centralized systems as the http for internet”.

What is inside DCRM?

There is 2 main API functions:

KeyGenerate which will create an on-boarding address for the user to lock in any funds from any that blockchain you want to interoperate with. The key is generated in such a way that at no point in time is the associated complete private key visible. You will then onboard your crypto currencies to the network by lock-in then in as a regular transfer. You stay in control of your funds with you unique personal Fusion portfolio, the transaction are stored and secured in a decentralize custody system.

Sign: you can sign inbound transaction or outbound transaction (lock-out) with you unique Fusion private key. The advantage is that for inbound transaction the Fusion layer serves a an trustless accounting system where a BTC transfer take seconds instead of hours and fees are cheap and easy to calculate.

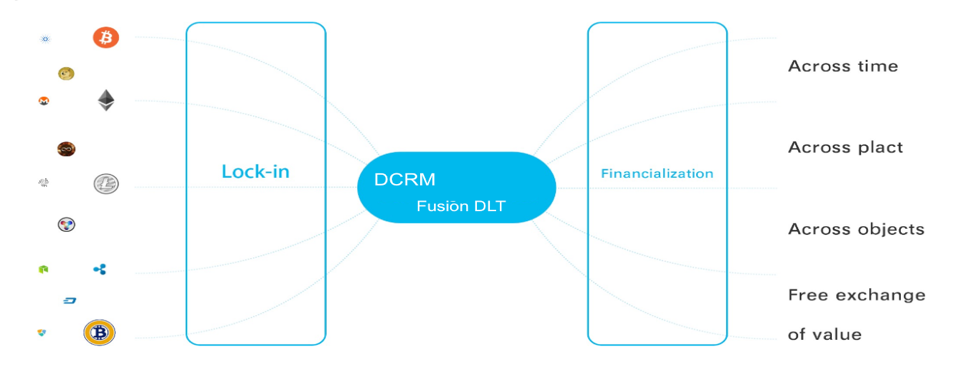

How does Fusion’s DCRM works?

A simple idea: You have 1 unique key to control any asset from any blockchains.

Mathematically secure: It uses el-Gamal, MPC, Zero Knowledge proof, Paillier homomorphic encryption and distributed threshold signature schemes like ECDSA and Edwards-curve Digital Signature Algorithm (EdDSA), and others. (Security review)

Any new user owning assets from several different blockchains (for example: BTC; NEO; EOS; ETH, etc.) will want to join Fusion by using DCRM. The first step is to generate a unique Fusion Key which is the key that will control any assets from any blockchains. Then the user will initiate Lock-In which consists of invoking the KeyGenerate API and creating an on-boarding address for each asset from any blockchains.

The user will create a transaction to make sure all his assets are on-boarded under the decentralized control of the DCRM, his balance and information are stored in the DCRM ledger (Fusion blockchain). Now all assets are controlled by the user’s unique key and asset representations has been created in the DCRM Ledger. This assets representations enable cross blockchain smart contracts. LO or Lock-Out is the process a user can initiate to withdraw assets by requesting DRCM to transfer his assets to any address of his choice.

In fact the combination of DCRM, which relies on owners granting rights of their assets to the Fusion algorithm, and LILO processes, users are able to exchange values across heterogenous digital assets in a single environment, and can do so knowing their assets are securely protected and managed by decentralized technology. More infos on this LILO article, or this one, and the below video.

Now that you have an understanding of what DCRM is, interoperability vs compatibility, lets compare the existing projects in the space.

Comparison table:

Advantages of DCRM:

Security: at all times in the Fusion ecosystem, the Fusion algorithm serves as an incorruptible protector of assets:

· No user can represent their own token balances falsely.

· No user can have their token balances manipulated falsely by others.

· Individual ownership of assets is tracked by transaction-level reconstruction of balances and aggregated in Fusion’s multi-token wallet.

· All transactions are verified by consensus and securely signed by the Fusion algorithm. Using an approach similar to the one used in generating and storing sharded keys, the private keys used for Fusion-managed balances are never wholly reconstructed even during the transaction signing process.

Freedom of choice:

For developers using a blockchain that has implemented DCRM like Fusion (other blockchains are also powered by Fusion’s DCRM) is a smart choice. Indeed the business logic is re-usable, is simple to use by following the well documented APIs and is valid across all blockchain ensuring a continuous support across all blockchain across all generations. This makes it easy to develop, easy to maintain and easy to migrate businesses to a blockchain that is powered by Fusion’s DCRM. This a future proof choice in a space where technology is evolving at a very rapid pace. DCRM represents real freedom and disintermediation, providing the ecosystem with a universal solution rather than a rigid and hard to implement standard like is being proposed by other blockchain projects.

The Fusion protocol offers out of the box financial functions, and is the first blockchain implementing DCRM, exchanging location, asset type, payment type, and trust are no longer limiting factors in value exchange. For example, an investor of real estate holding EOS tokens in Asia can now find and invest in a property in the US that was digitized as an Ethereum asset that pays in ETH, without having to look at two separate blockchains and swap token types in an exchange.

Conclusion: Regardless of the technical legacy systems or if the chain is public or private, with DCRM everything can be connected. DCRM is the best way to save blockchains from being isolated and difficult to integrate into other technical systems, and it is a bridge for the expansion and connection of the blockchains and DLT ecosystem. Thanks to the DCRM cryptographic breakthrough you can have tokens freely circulating, smart contracts to support cross-chain transactions you create and consume rich financial applications taking the world to the era of internet of value.

Get started now! Any system or blockchain can implement DCRM as it is an open source protocol to control any other blockchain. have a test at https://dcrm.network/#/

Check the fusion foundation website at https://fusion.org/

Check XDLT, the universal blockchains indexer at https://xdlt.tech

Follow me at https://linkedin.com/in/kczrh/

contact me karim@fusion.org

References: complete list of interoperability projects

(please message me if some are missing):

Fusion https://www.fusion.org/

Wanchain https://wanchain.org/

Polkadot https://polkadot.network/

Cosmos https://cosmos.network/

Interledger protocol https://interledger.org/rfcs/0003-interledger-protocol/

BTC Relay http://btcrelay.org/

Lightning Network HTLC hash locking technology https://lightning.network/

AION https://aion.network/

ICON https://icon.foundation/

Block Collider https://www.blockcollider.org/

Ark https://docs.ark.io/introduction/ark/interoperability-and-ark.html

Holochain https://holochain.org/

Atomic Swaps https://en.bitcoin.it/wiki/Atomic_swap

Komodos https://komodoplatform.com/interoperability-cross-chain-smart-contracts/

Blocknet https://blocknet.co/blocknet/about/

Lamden https://lamden.io/

Metronome https://medium.com/georgetown-financial-technology-newsletter/bloq-and-the-metronome-project-bringing-longevity-and-cross-chain-interoperability-to-the-56b299c7f93d

Quant Network https://www.quant.network/technology/overledger/

Dragonchain https://dragonchain.com/

Auxledger https://auxesisgroup.com/technology.html

EXRN https://exrnchain.com/

EOS https://www.eoscanada.com/en/qa-how-inter-blockchain-communication-works-on-eos

Other interesting articles on the topic:

https://medium.com/@Zhaojun.sh/%E5%8C%BA%E5%9D%97%E9%93%BE3-0-%E8%B7%A8%E9%93%BE%E6%8A%80%E6%9C%AF-8a0287b9232b

https://hackernoon.com/whats-the-next-step-in-blockchain-technology-f479c425027a

https://hackernoon.com/https-medium-com-specrationality-block-collider-a-new-approach-to-blockchain-interoperability-60eab1b21ae6

https://freestartupkits.com/articles/technology/cryptocurrency-news-and-tips/best-cross-chain-protocols-for-blockchain-interoperability/

http://troubles.md/posts/comparison-of-inter-blockchain-communication-technologies/

https://www.investinblockchain.com/blockchain-interoperability-projects/

https://blockonomi.com/blockchain-interoperability/

https://blockonomi.com/what-is-polkadot/

https://101blockchains.com/blockchain-interoperability/

https://medium.com/blockchain-capital-blog/a-primer-on-blockchain-interoperability-e132bab805b

https://hackernoon.com/overcoming-the-lack-of-interoperability-between-blockchains-d3fb5ccc308a

https://medium.com/coinmonks/interoperability-the-holy-grail-of-blockchain-eb078e1a29cc

0 Comments